Artificial Intelligence in Financial Technology (Fintech): Combating Fraud and Personalizing Finance

Artificial Intelligence in Financial Technology (Fintech): Combating Fraud and Personalizing Finance

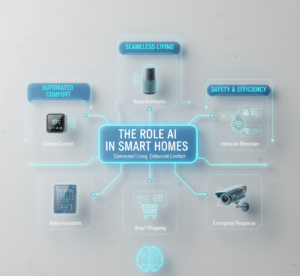

The financial technology business is undergoing a transformation as a result of artificial intelligence, which provides cutting-edge solutions for fraud detection in real time and financial services that are tailored to the individual. Artificial intelligence (AI) improves the level of security, efficiency, and customer experience in the banking and financial services industries by doing analyses of large datasets and identifying trends.

Detection of Fraud in Real Time

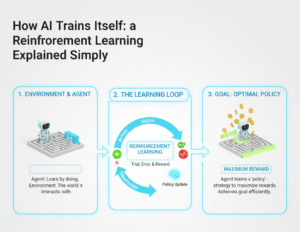

Artificial intelligence (AI) algorithms are able to detect fraudulent activity at a quicker pace and with more accuracy than conventional systems:

- Pattern Recognition: Artificial intelligence (AI) is able to identify any transactions or behaviors that seem out of the ordinary, and it can immediately flag any transactions that could be fraudulent.

- Adaptive learning is a strategy that allows machine learning models to develop in conjunction with the latest strategies used by criminals in order to maintain an advantage over them.

- Multi-Layer Security: Integrating artificial intelligence (AI) with biometrics, device identification, and behavioral analysis makes account security more robust.

- Not only can real-time detection lead to a decrease in financial losses, but it also results in greater customer satisfaction and confidence.

Banking Services That Are Tailored to the Individual

Artificial intelligence (AI) makes it possible for financial technology (fintech) businesses and banks to provide financial services that are very personalized:

- Recommendations tailored to the individual are generated by Artificial Intelligence (AI), which evaluates spending habits, savings patterns, and investment objectives in order to provide advise that is specific to each person.

- Smart Budgeting and Alerts: Clients are provided with insights that are generated automatically, which provide recommendations on how to save money or manage their finances.

- Artificial intelligence (AI) recommends credit cards, loans, or other investment prospects that are appropriate for each person’s specific profile via dynamic product offerings.

- Engagement is improved via personalization, which assists consumers in feeling that they are understood and supported as they navigate their financial journeys.

Credit Risk Assessment Using Artificial Intelligence

Artificial intelligence also revolutionizes the loan industry by offering more precise evaluations of credit risk:

- Alternative Data Analysis: Artificial intelligence assesses income, spending habits, and social conduct in addition to credit ratings.

- Bias Reduction: When artificial intelligence (AI) models are trained appropriately, they are capable of reducing human bias in choices about lending.

- Decisions are Made More Quickly: Loan approvals are expedited by automated analysis, which enhances consumer satisfaction.

Preventing Fraud Outside of the Financial Sector

Artificial intelligence (AI) in the financial technology (fintech) industry also include insurance, payment systems, and investing platforms:

- Verification of insurance claims: Fraudulent claims are discovered by use of anomaly detection.

- Payment security: Transactions that occur over payment networks and digital wallets are monitored by artificial intelligence.

- Investment Protection: It is able to detect patterns of insider trading or other market actions that seem to be questionable.

Difficulties and Factors to Take into Account

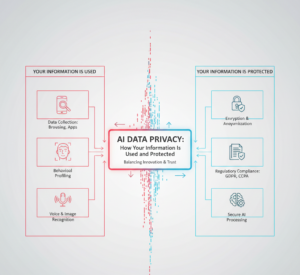

The use of artificial intelligence in financial technology (fintech) has many benefits, but it must be used with caution:

- Data privacy: It is of the utmost importance to protect sensitive financial information.

- Compliance with rules: Artificial intelligence (AI) solutions are obligated to abide by financial rules and requirements for reporting.

- Transparency in Models: In order to preserve confidence, it is essential to ensure that judgments made by artificial intelligence are fair and can be explained.

- Dangers to Cybersecurity: Artificial intelligence systems themselves are in need of protection from potential cyberattacks.

Artificial intelligence is revolutionizing financial technology (fintech) by providing strong instruments for the prevention of fraud and the provision of financial services tailored to the individual. Artificial intelligence (AI) has the ability to improve both operational efficiency and consumer pleasure by combining security, speed, and customisation.

Artificial intelligence will continue to play a bigger and more important part in the development of a financial ecosystem that is safer, more intelligent, and more customized as it makes further advancements.